Mpay Payment

Gateway

Service

Mpay Payment Gateway

A comprehensive digital payment ecosystem provides

world-class

security standard payment

solutions with

cutting-edge

technology for utmost security standards through

PCI-DSS

compliance.

Features a variety of functionalities, including expert consultancy to support all types of

online business in boosting sales and enhancing convenience in operations, all under regulated by

the Bank of Thailand and the

Anti-Money

Laundering Office.

Why Choose

Mpay Payment Gateway ?

Product & Service Highlight

Mpay Payment Gateway

Offers a variety of payment channels to choose from, catering to customer needs, providing convenience, and enhancing sales opportunities for businesses.

Complied with International security standards, certified by PCI-DSS , ISO27001M , ISO22301 , and cutting-edge Cloud Technology from AIS

24-hr Monitoring System & Dedicated Call Center for Customer Service.

Understanding and providing payment solutions to support all business requirements

Online and real time

payment transaction

Dashboard and data analytics

for supporting

Authorized User to

access reports

Supports multi-bank transfers

Create and send payment links

via SMS, Email, and other channels

Customize sales reports

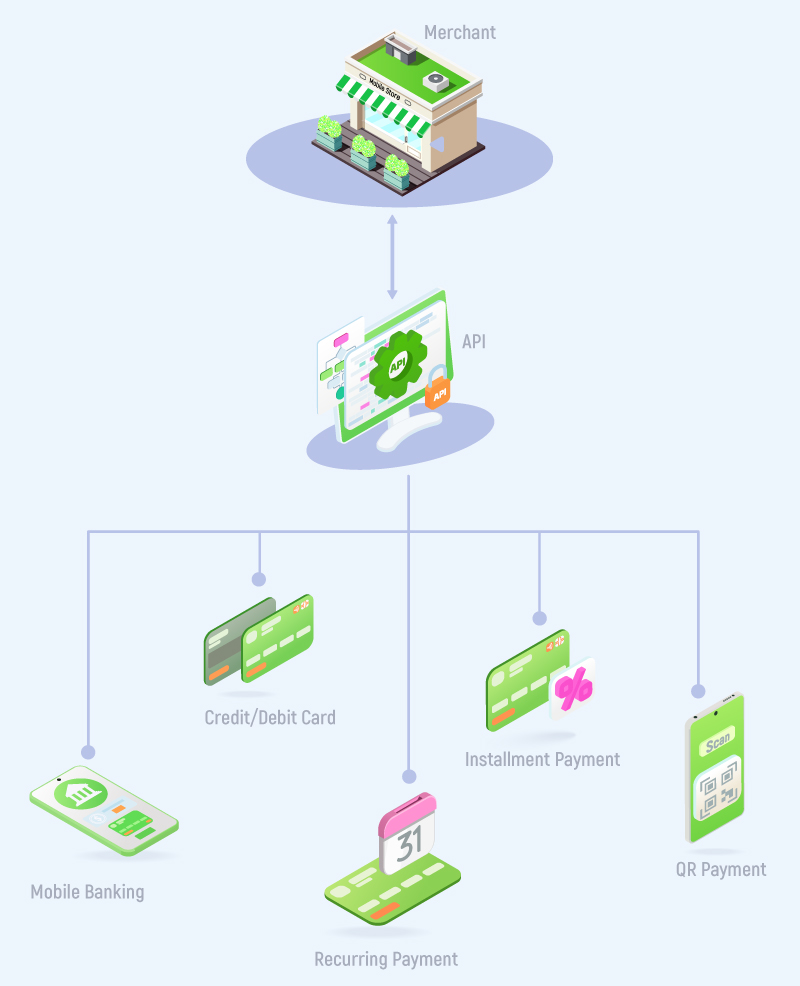

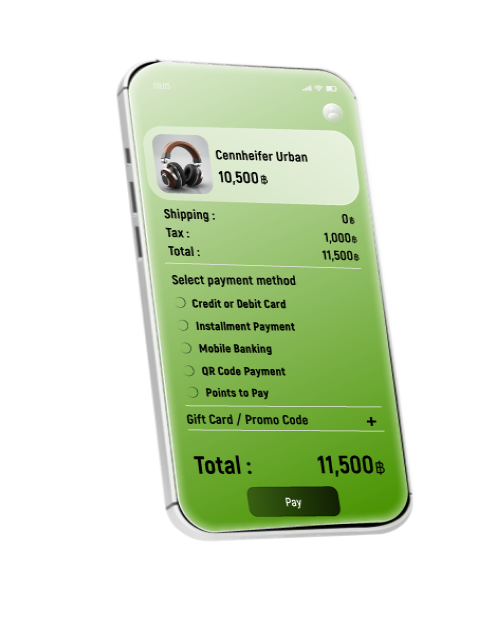

Payment Method

Mpay Payment Gateway

Credit Cards, Debit Cards

Installment Payments

Mobile Banking

QR Payment

E-Wallet

Points to Pay

Service Fees

Mpay Payment Gateway

| Payment Method | Transaction Fee* | |

|---|---|---|

| Credit Cards, Debit Cards |

|

3.50% |

|

3.65% | |

| Installment Payments |

|

3.00%

* Interest not included |

| Mobile Banking |

|

15 Baht |

| QR Payment |

|

1.50% |

| Local Wallet |

|

3.00%

Digital content merchants

|

|

15 Baht | |

| International Wallet |

|

3.00% |

| Points to Pay |

AIS Points can be used for discounts in conjunction with other payment methods |

2.00% |

|

* Payments are charged per successful transaction. The transaction fee as shown is subject to 7% VAT.

For established businesses with large online payment volume or unique business needs, Contact us = |

||

Customers Confidently Choosing

Mpay Payment Gateway

Hospital and Well being Sector

Consumer Goods Sector

Real Estate Sector

Financial Institutions Sector

Insurance Sector

Vending Machine Business Sector

Foundations Sector

Lifestyle Sector

Frequently Asked Questions (FAQ)

Mpay Payment Gateway is a comprehensive digital payment management system of international standards on a

world-class

network.

It offers modern, secure payment services for all businesses.

We provide services to individuals, legal entities, educational institutions, foundations, and hospitals.

There is no fee to register for the Mpay Payment Gateway service. The company charges a fee based only on actual transaction activities.

- Support credit card payments (VISA, MasterCard, JCB, UnionPay, AMEX) with 3D Secure complying with the highest level of the PCI-DSS standard

- Support Mobile Banking (App Switch) , QR PromptPay and E-Wallet service

- Remember customer credit card for future transactions.

- Support installment payments via credit card.

- Merchants receive payments on the next business day and no minimum transaction amount required for merchant payouts.

- Online merchant, such as websites, ecommerce pages, merchant on social media platforms and merchant application

- Offline merchant with physical locations

- General stores: 7-14 days

- Stores that accept credit card payments: 14-21 days

To register for Mpay Payment Gateway, click

here.

For legal entities

- A copy of the business registration certificate

- A copy of the shareholder list

- A copy of the ID card/house registration of the authorized signatory

- A copy of the Certificate of Value Added Tax registration. (Form Por.Por.20) issued by the Revenue Department (if applicable)

- A copy of a savings or current account statement (in the name of the legal entity)

- A picture of the company logo or trademark (if available)

- Documents verifying other business operations, such as hospitals, clinics, pharmacies, hotels, tourism (if applicable)

- A copy of the owner's ID card/house registration

- A photo of the person with their ID card

- A photo of the store location or Merchant Page on online channel

- A copy of the Certificate of Value Added Tax registration. (Form Por.Por.20) issued by the Revenue Department (if applicable)

- A copy of a savings or current account statement (the account name must match all other documents)

- A picture of the store logo or trademark

- Contact Center Phone Number: 02-078-9299

- Email: mPAY-Followup@ais.co.th

| Payment Method | Transaction Fee* | |

|---|---|---|

| Credit Cards, Debit Cards |

|

3.50% |

|

3.65% | |

| Installment Payments |

|

3.00%

* Interest not included |

| Mobile Banking |

|

15 บาท |

| QR Payment |

|

1.50% |

| Local Wallet |

|

3.00%

Digital content merchants

|

|

15 Baht | |

| International Wallet |

|

3.00% |

| Points to Pay |

AIS Points can be used for discounts in conjunction with other payment methods |

2.00% |

|

Payments are charged per successful transaction. The transaction fee as shown is subject to 7% VAT.

For established businesses with large online payment volume or unique business needs, Contact us |

||

The system will summarize the sales transactions at the end of each day, and the money will be transferred to the merchants on the next business day,

no later than 16:00. Merchants can view detailed reports of their sales transactions and money transfer for each day via the merchant

self-service

portal.

None. (*Conditions as specified by the company)

| Settlement | |||

|---|---|---|---|

| Settlement within 1 business day (T+1) | Settlement within 3 business day (T+3) | ||

| Bank Account | Bank of Ayudhya PCL | Government Savings bank | |

| Siam Commercial Bank PCL | Bank for Agriculture and Agricultural Cooperatives | ||

| Bangkok Bank PCL | Kiatnakin Phatra Bank PCL | ||

| Kasikornbank PCL | Standard Chartered Bank (Thai) PCL | ||

| Krungthai Bank PCL | |||

| CITIBANK, N.A. | |||

| TMBThanachart Bank | |||

File type: .CSV, .XLXS

Contact Center

02-078-9299

02-078-9299

mPAY-Followup@ais.co.th

mPAY-Followup@ais.co.th

02-078-9299

02-078-9299

mPAY-Followup@ais.co.th

mPAY-Followup@ais.co.th